Overview of Operating Environment

The operating environment was characterised by increased activity across key economic sectors. The average blended inflation rate for the quarter under review was 19.6% up compared with 31.7% and 56.3% in Q2 2023 and the corresponding period last year, respectively. The downward trend has largely been due to policy tightening and elevated monitoring of financial transactions by the Authorities to contain speculative off-market foreign currency transactions. However, there had been high uncertainty around inflation and exchange rate stability despite some contractionary monetary and fiscal measures introduced by the government.

The local unit has been responding to market dynamics on the interbank. This has seen the interbank market rate appreciating by 5% during the quarter. However, the average parallel market was about 32% compared with the internationally acceptable range of 10%-20%, and 39% in the previous quarter. However, huge parallel market premiums have had a huge cost-push effect on local inputs.

At a business level, most tenants paid rentals in US dollars while the local currency was mainly used to cover operating costs. Management continued to adapt its strategies to the changes in the external environment to deliver on operational excellence and strategy.

Sustainability

The Group will continue to run its operations sustainably in line with the environmental, social and governance (ESG) requirements. Adopting “green” operations, including investing in a solar power plant, energy efficient operations and waste management initiatives, remain critical to the Group’s strategy. We will continue to enhance the Group’s ESG framework in line with the global trends.

Expansion programme

The Group is currently investing in the expansion of the Arundel Office Park which is currently at 75% completion level. This is significant to the Group, the shareholders and other key stakeholders given its transformative impact on the Group’s portfolio. To date a total of USS3,286,875.98 has been spent on the project. Project commissioning is expected by 27 March 2024.

Dividend

At a meeting held on 8 November 2023, the Board of Directors recommended that no dividend should be paid for the current quarter, and the available cash be channeled towards the expansion programme.

Property Market Overview

Providing space in the right form, location and quality remains a key issue in the property market. The demand for Central Business District (CBD) offices continued to fall due to the “substitution” effect from alternative facilities along major arterial routes.

Access to long-term funding and currency and sustainable property development in the country. It is against this background that the industry has continued to explore innovative funding structures resulting in significant residential, retail, industrial and space repurposing developments in the country. Further, there has been increased expenditure on public infrastructure.

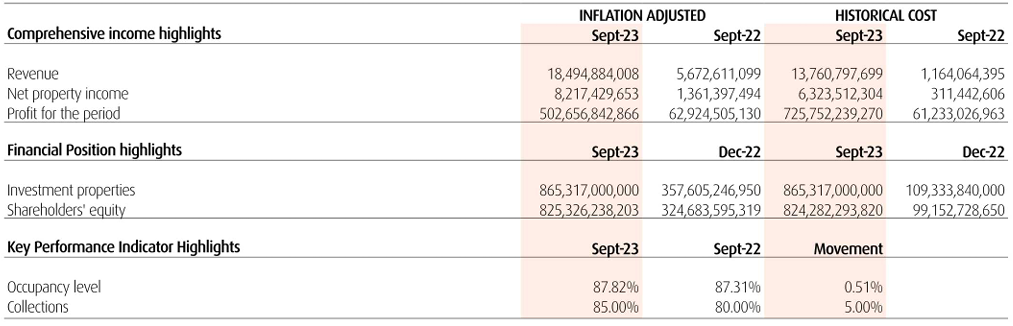

Financial Performance Highlights

Financial Performance

Revenue for the period increased by 226.04% compared to the same period in the prior year, driven by rent reviews, improved pure US dollar business and a marginal increase in the occupancy level to 87.82% from 87.31% in the corresponding period last year. Net property income increased by 503.60% during the period due to improved levels of rental income. It should be noted that rental income is the Group’s main revenue driver. A total of ZWL 1.5 billion was applied to property maintenance during the period ended 30 September 2023. Investment properties at 30 September 2023 were valued at ZWL 865.317 billion, a 141.98% fair value gain from the 31 December 2022 value of ZWL 357.606 billion.

Outlook

The business will continue to implement its growth strategy to increase shareholder value. This includes investing in sustainable, “all-weather” assets that withstand macro and industry-induced exogenous shocks. Key stakeholder and client- relationship management will be prioritised in the outlook. Management will also focus on property refurbishment, maintenance, and upgrades to ensure the delivery of a competitive product to its invaluable business partners.

By order of the Board

Mrs Dulcie Kandwe

Company Secretary