Overview of Operating Environment

The operating environment remained challenging during the quarter under review, with the country going through differing levels of lockdown due to the ongoing COVID-19 pandemic, hindering normal business trading. During the period under review, inflation decelerated from 106.64% in June 2021 to 51.55% in September 2021, while the local currency weakened marginally against the US dollar from 85.4234 as at 1 July 2021 to 87.6653 at quarter end. Towards the end of the quarter, the easing of lockdown restrictions improved business trading hours, allowing relatively normal operations to resume.

Property Market Overview

The property market remains subdued with persistent demand and supply imbalances affecting pricing, while subdued macro-economic fundamentals dampened demand for space driven by excess supply in the CBD offices.

Pricing of rentals continue to evolve, with property owners seeking to hedge against inflation and currency depreciation risk by shortening rent review periods and adopting pricing models within the confines of prevailing legislation.

There continues to be limited development activity, with the majority of developments being mainly owner occupied industrial / retail warehousing projects, office park style buildings and residential to commercial conversions in suburbs just outside the CBD. The pandemic continues to affect the construction sector with delivery of projects being slowed down due to site safety requirements in line with COVID-19 protocols, and contractors also adapting supply chain schedules to cater for increased delivery timeframes.

Financial Performance Highlights

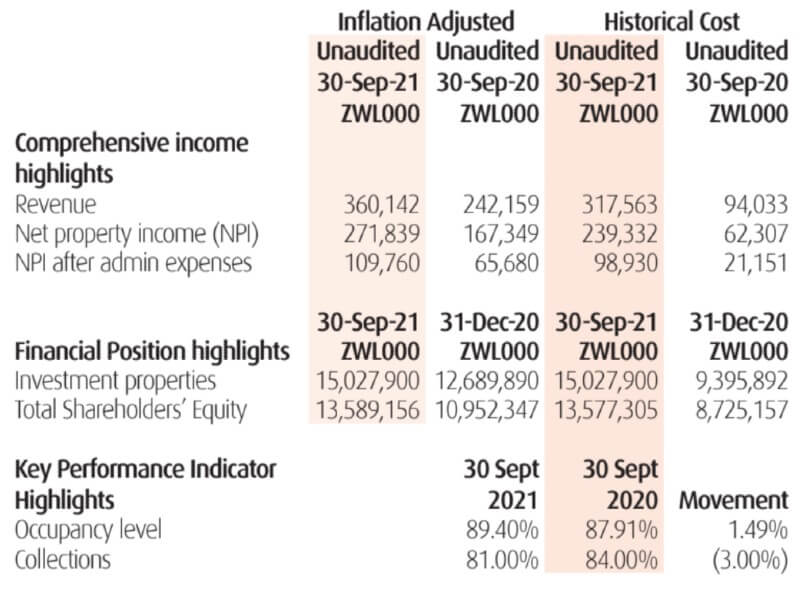

Revenue at ZWL 360.14 million, increased by 49% compared to the same period in the prior year, driven by rent reviews, turnover rentals and the occupancy level rising to 89%. The business saw positive movement in occupancy levels especially in the CBD Office sector, closing the quarter at 72%. The performance of the office park, industrial and retail sectors remained resilient despite the COVID-19 pandemic.

Net property income grew by 62% during the period driven by revenue growth and cost containment measures. The business however continued to invest in repairs and maintenance to upgrade space and accelerate leasing efforts, with a total of ZWL 20.79 million reinvested during the period under review. Administration expenses to revenue ratio stood at 38% for the period as digital strategies were accelerated in addition to deliberate efforts to retain talent. Investment properties at 30 September 2021 were valued at ZWL 15.028 billion following a Directors valuation.

Impact of COVID-19

Economic activity improved in the third quarter of 2021 as the Government of Zimbabwe relaxed lock down measures in response to the reduction in COVID-19 infection cases coupled with a steady COVID-19 vaccination roll out. The lockdown early in the year delayed rent review efforts, hindered collections and planned maintenance initiatives, with significant effort made in Q3 2021 to bridge the gap. The maintenance initiatives completed during the quarter included routine maintenance as well as initiatives to ensure properties are safe for occupation in line with new occupier expectations created by the pandemic. Collections deteriorated during the quarter to 81% (Q2 2021: 82%) as tenants remain affected by the varying lockdowns to generate income to clear their obligations. The company continues to prioritise the health and safety of staff and our tenants, implementing digital strategies, remote working as well as enhanced sanitation procedures at all our properties.

Sustainability

Following the execution of an Engineering Procurement Construction contract in April 2021 for a renewable energy plant at First Mutual Park, the project closed the period at 99% completion, with the final testing and snagging to be completed before full commissioning of the solar energy plant. The Group has plans to roll-out waste separation infrastructure at various properties across the portfolio as part of our sustainability strategy.

Dividend

At a meeting held on 8 November 2021, your Board resolved that a third interim dividend of ZWL 13,982,820 being 2.0331 ZWL cents per share be declared from the profits for the quarter ended 30 September 2021. The dividend will be payable on or about 17 December 2021 to all shareholders of the Group registered at close of business on 3 December 2021. The shares of the Group will be traded cum-dividend on the Zimbabwe Stock Exchange up to 30 November 2021 and ex-dividend as from 1 December 2021.

Outlook

The easing of lockdown restrictions in response to improved COVID-19 management and monitoring efforts is expected to enhance economic activity, thereby improving tenants’ financial performance and capacity to settle their lease obligations.

Inflationary pressures are expected to stabilize as the authorities continue to monitor the respective economic indices and implement monetary policy measures to manage inflation and money supply.

The commercial real estate segment is expected to remain an occupiers market due to excessive supply of space, with pricing models evolving to hedge against inflation and currency depreciation risks. Development activity is expected to remain buoyant in the residential sector, with steady uptake of commercial developments in the retail, industrial and office park sectors.

Value preservation and cash flow management remains critical in the immediate to short term as the impact of COVID-19 on cash flows remains relatively uncertain until the country achieves herd immunity.

By Order of the Board

Mrs Dulcie Kandwe

Company Secretary